DOGE Price Prediction: Can It Reach $1 or Will Competition Take Over?

#DOGE

- Technical Weakness: DOGE trades below its 20-day MA, signaling short-term bearish pressure.

- Market Sentiment: Mixed reactions due to macroeconomic risks and institutional outflows.

- ETF Speculation: Potential 2025 approval could provide long-term upside.

DOGE Price Prediction

DOGE Technical Analysis: Key Indicators and Trends

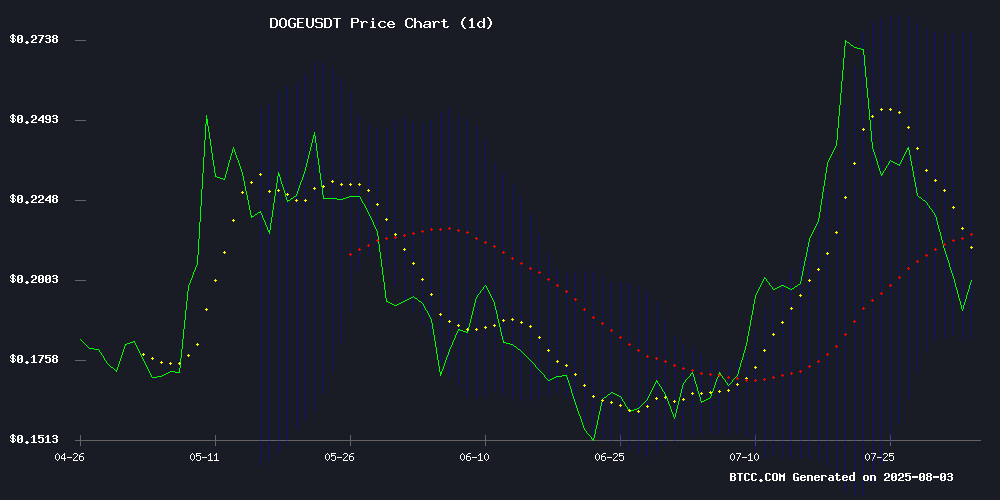

According to BTCC financial analyst Olivia, Doge is currently trading at $0.20038, below its 20-day moving average (MA) of $0.229075. The MACD indicator shows a slight positive momentum with a value of 0.003638, but remains in negative territory overall (-0.018225). Bollinger Bands suggest potential volatility, with the upper band at $0.275883 and the lower band at $0.182266. These indicators suggest a cautious outlook in the short term.

DOGE Market Sentiment: Mixed Reactions Amid Macro Pressures

BTCC financial analyst Olivia notes that Dogecoin faces mixed sentiment due to macroeconomic pressures and institutional outflows, as reflected in recent headlines. While some predict a potential ETF approval in 2025 and highlight a 310% surge in trading volume, others caution about resistance levels and competition from newer tokens like PropiChain. The market remains divided on DOGE's ability to reach $1.

Factors Influencing DOGE’s Price

Dogecoin Slides Amid Macroeconomic Pressure and Institutional Outflows

Dogecoin dropped 4% to $0.19 as global risk aversion triggered selloffs across speculative crypto assets. Trading volumes spiked to 918 million DOGE during the session, nearly triple the 24-hour average, confirming strong exit momentum.

The meme coin found temporary support near $0.188 after failing to hold above psychological resistance at $0.20. Market sentiment deteriorated following the Fed's decision to maintain rates and escalating global trade tensions affecting 92 nations.

Dogecoin (DOGE) Drops to $0.20 as Institutional Accumulation Signals Mixed Market Sentiment

Dogecoin trades at $0.20, marking a 2.86% decline over the past 24 hours. The meme coin's recent weakness follows an 8% drop on August 1st, with trading volume surging to 1.25 billion DOGE. Despite the selloff, institutional wallets accumulated 310 million DOGE, suggesting strategic buying at current levels.

Technical indicators show neutral to oversold conditions, with the RSI at 41.14. Seasonal trends add pressure, as August has historically been challenging for cryptocurrencies. The juxtaposition of institutional accumulation against broader market pessimism creates a complex narrative for DOGE's near-term trajectory.

Dogecoin (DOGE) Price Prediction and Technical Analysis

Dogecoin (DOGE) remains the leader of the meme coin sector. Originally created as a joke in 2013, Dogecoin’s growth has been remarkable. The main question is how high Dogecoin can go, especially with the meme coin industry seeing a huge surge in popularity. While early meme coins like Dogecoin relied mostly on community engagement, new cryptos are integrating advanced technologies.

Can Dogecoin Reach $1, or Is a Stronger Competitor Set to Take the Lead?

The article discusses the unpredictability of Dogecoin's price and compares it to Elon Musk's tweets. It mentions the difficulty in predicting Dogecoin's price and wonders if it can reach $1 by 2025. The article also introduces Dawgz AI, a cryptocurrency still in presale, as an alternative investment option.

Dogecoin Price Speculation Amid Trump and Musk's Reactions

President Trump recently announced the establishment of a U.S. strategic crypto reserve, excluding Dogecoin from the initial list.尽管如此,这一公告引发了整个加密货币市场的动荡,许多人猜测DOGE未来是否会被加入。Reports indicate that Trump’s stance is fueling optimism across the market. Meanwhile, Elon Musk, a long-time Dogecoin supporter, reacted to discussions surrounding DOGE’s absence, maintaining his association with the cryptocurrency, which remains a major price driver.

Dogecoin ETF Approval Likely in 2025

The US Securities and Exchange Commission (SEC) is currently reviewing multiple filings related to the potential listing of Dogecoin-based exchange-traded funds (ETFs). NYSE Arca has filed a 19b-4 seeking approval to list Bitwise’s Dogecoin ETF, with Coinbase Custody managing the Dogecoin holdings and Bank of New York Mellon overseeing the cash assets. The ETF aims to track the market value of Dogecoin using the CF Dogecoin-Dollar Settlement Price. Alongside Bitwise, Grayscale and Rex Shares have also sought approval for a Dogecoin ETF, with Grayscale’s application further along in the SEC's review process.

Dogecoin Shockingly Defies Odds: Trading Volume Soars 310% to $4.06 Billion

Dogecoin (DOGE) experienced a significant rise, defying odds despite being excluded from the U.S. Crypto Strategic Reserve. The trading volume surged by 310%, reaching $4.06 billion. From late February to early March, DOGE climbed from $0.2019 to $0.2417, marking a 19.7% increase. Analysts predict potential further price increases, with some forecasts suggesting a rise to $0.494299 by March 8.

Can Dogecoin Reach $1: Realistic Predictions and Market Analysis

The article discusses the possibility of Dogecoin reaching $1. It mentions that initially, a $1 Dogecoin felt like a fantasy but now people are still chasing that dream. It highlights that while Dogecoin keeps people guessing, Dawgz AI is already attracting new investors daily and is a whole new breed. The article concludes by asking if Dogecoin has the bite to match its bark and whether it can reach $1 in 2025.

Dogecoin Price Faces Resistance; PropiChain Gains Traction for 30,000% Surge Potential

The Dogecoin price is currently at a critical point, with key resistance faced at the $0.30 mark and support at $0.195. While this range is a cause for concern for some investors, PropiChain, a token silently picking up speed for a potential 30,000% surge, is starting to gain widespread attention. The current Dogecoin price is $0.1987, a 36.28% decrease from a month ago.

Will DOGE Price Hit $1?

BTCC analyst Olivia suggests that DOGE faces significant hurdles to reach $1 in the near term. Current technical indicators show weak momentum, and market sentiment is divided. Below is a summary of key data:

| Metric | Value |

|---|---|

| Current Price | $0.20038 |

| 20-Day MA | $0.229075 |

| MACD | 0.003638 (Weak Bullish) |

| Bollinger Bands | $0.182266 - $0.275883 |

While ETF speculation and high trading volume provide optimism, resistance levels and macroeconomic risks may delay a rally to $1.